Indian Bank Credit Card

Hi, this is Prashant here to tell you the easiest step on how to apply for an Indian bank credit card and how to activate it without going to your branch bank.

How to activate an Indian bank credit card? Is the most common questions asked by the Indian bank Credit Card holders

How to Apply for Credit Cards?

For this, you have to visit to your bank and apply for credit card and then submit it there. If you feel any problem you could ask for help from assistant manager they are there to help you.

The Requirement to apply for a credit card

- Aadhar Card

- Pan Card

- Passbook

After applying for it, it can take up to 1 month to come to you.

How to Activate Indian Bank Credit Card?

For activation process you should have access to a high speed internet connection. Here, You should activate it from Google Chrome on your personal computer or on your personal laptop because it allows secure connection.

You can follow some simple steps to activate it within 10 minutes only form home.

Creating User ID and Password

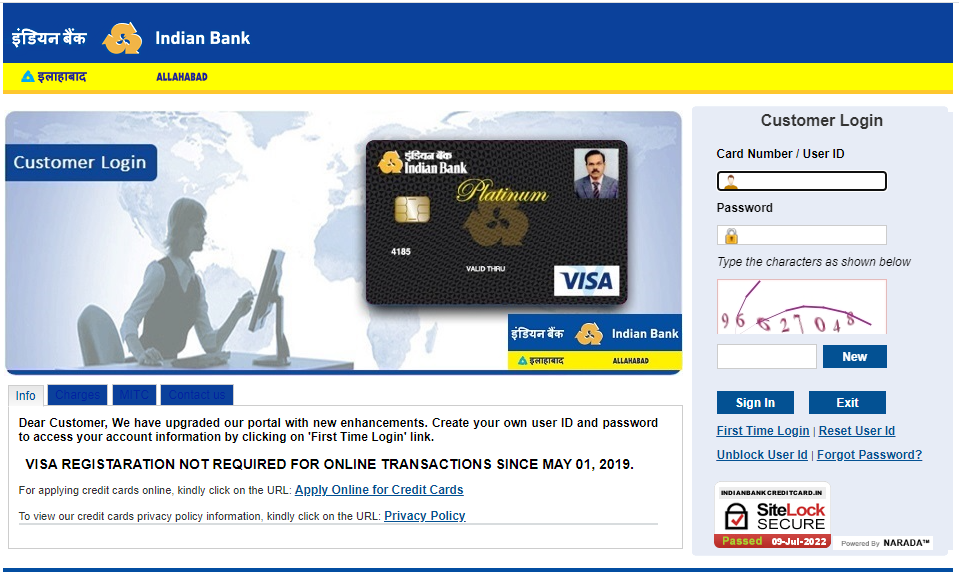

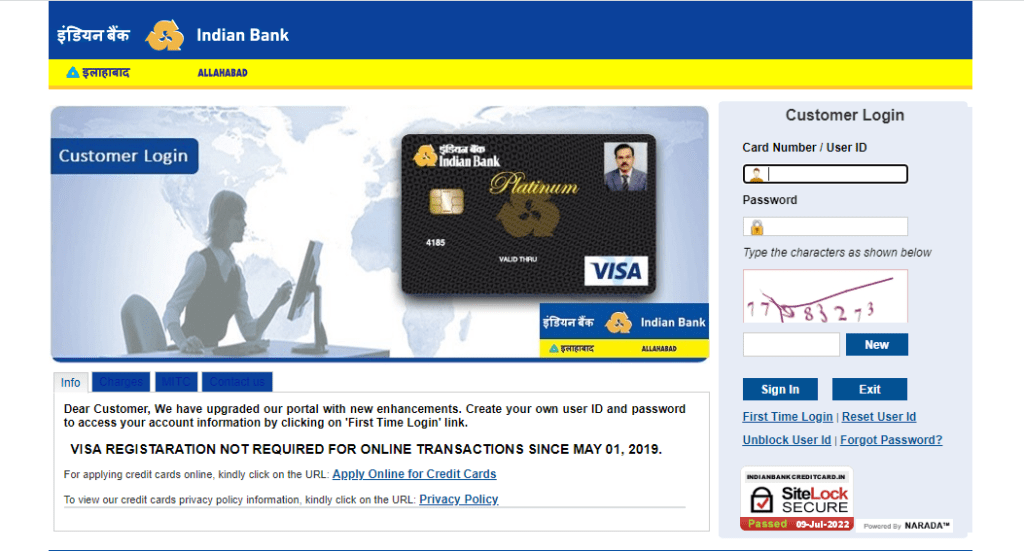

Step 1 – Visit Indian Bank Credit Card Portal manually or click here.

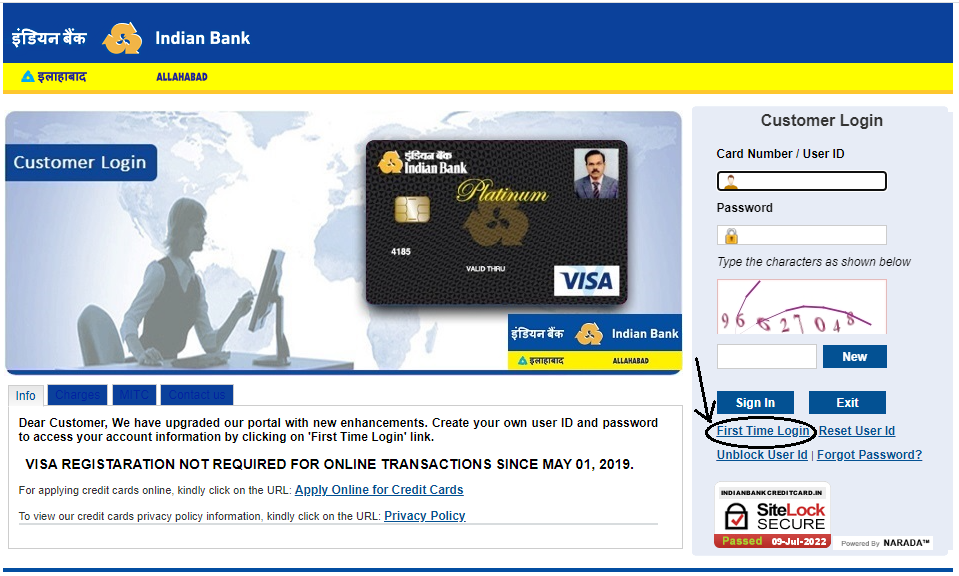

Step 2 – And then, Click on the First time Login button.

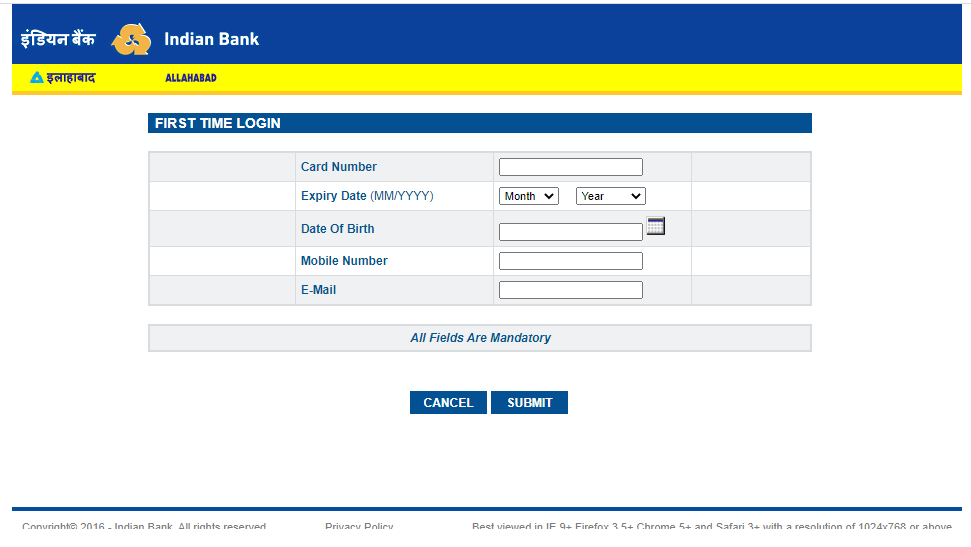

Step 3 – Fill the credentials. Similarly, as shown here.

- Card Number

- Expiry Date in (MM/YYYY) format

- Date of birth (Which is updated on bank details)

- Mobile Number (Which is updated on bank details)

These details should be matched with bank details.

Step 4 – After submitting it. You will receive OTP on your registered Mobile Number and then fill it.

Step 5 – You have to Create a Strong User ID and a Strong Password which should be comprises of

- An Upper Case letter

- A Lower Case letter

- A Special character

- A Number

Step 6 – Now, your User ID and Password will be accepted. So, you can come to home menu where you have started.

Login Process

Step 7 – Fill the Credentials you have created now. User ID and Password which you have created just now.

Step 8 – Type the character as shown in the captcha box. If you haven’t received any captcha on your screen. Then, click on the New button.

Step 9 – Click on the Sign In button.

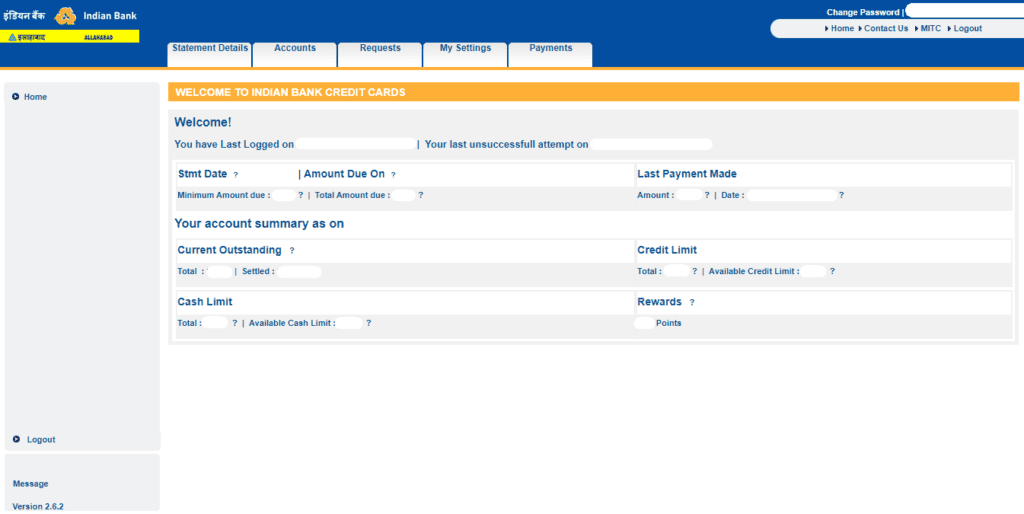

Step 10 – It will be redirected to your Credit Card Home Profile.

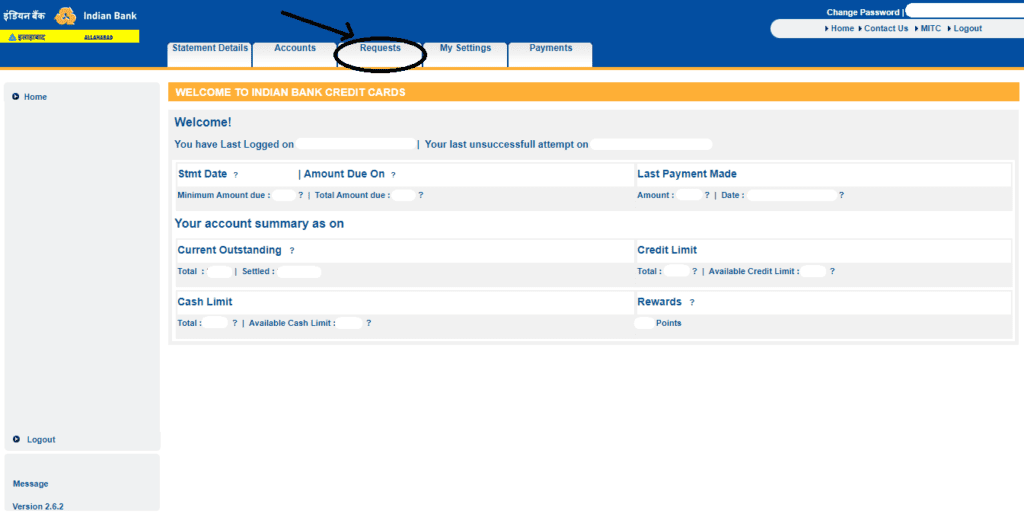

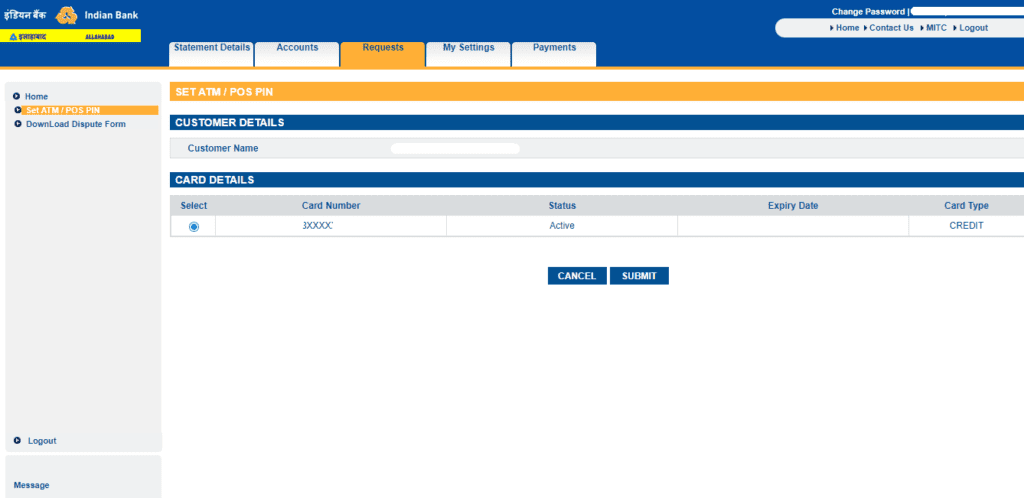

Step 11 – Here, you have to click on the Request button.

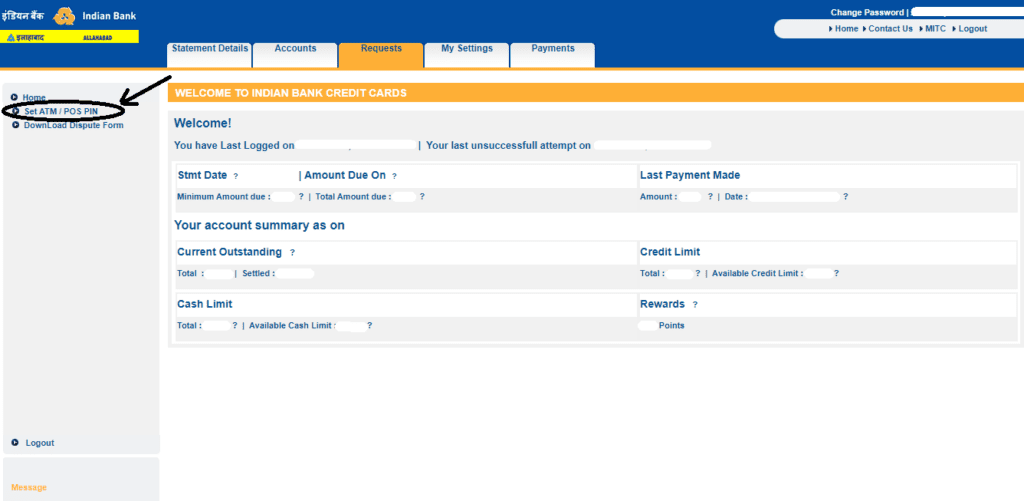

Step 12 – Then, click on SET ATM/POS PIN from the menu bar. For further, follow the step below.

Step 13 – Check that it’s your credit card by seeing the last four digits of the Card Number. Then, click on the SUBMIT button.

Step 14 – Fill the OTP which is received on your registered mobile number

Here, you have completed activation process and you will get a message of Success.

Now, Your debit card can be used anywhere. You can use it in shopping malls, Fuel Stations, or anywhere where POS is available. It can be also used it in ATM for instant cash.

Note – Firstly, You can change this POS/ATM PIN anytime. Secondly, You can see your transaction history anytime by login to Credit Card Portal. Thirdly, when you will pay for your bills your transaction amount will be updated after 24 hours,

Quarry for Credit Card Related Issue

For Credit Card customer care Number you can see the back side of the Credit Card or you can call on the Indian Bank Call Centre on 1800-425-0000

For IVR Call Related Issue

You can call on the same number 1800-425-0000 and here you can reset your PIN. Not POS/ATM pin, but simple transaction related issues. Likewise, to know your transaction details. You can call here to STOP all the transaction if your card is lost. Also, if you want to block all the card related services just call on this number and follow the instruction.

How much it costs for shopping POS

If you purchase some item through your credit card, then you have to pay some extra money for it. Therefore, if you have to spend 100 Rupees, then you have to pay 101 Rupees. Likewise, if you pay 1000 Rupees, then you have to pay 1010 Rupees. Which is 1% of the borrowed money. Therefore, we can say that for every 100 rupees we have to spend 1 rupees. But, this is applicable only up to 9999 rupees only. When you will spend 10000 rupees and more you have to pay 1.18% of the total amount you have POS or shopped. To clarify, we will take an example, if you spend 25000 rupees, then you have to pay 25295 rupees.

How much the receiver gets

For any sale, as a shopkeeper or receiver you have to pay for 2.5-3%. For instance, if you received 2500 rupees, then you will get only 2437.5 rupees that are 2.5% of the total sum for 3% you have to pay 2425 rupees.

Some Extra Features for the Payment of your Credit Card Bills

Indian Bank Credit Card provides some excellent feature for the payment. Now you can pay the bills in EMIs. So, in this method if you have spent more than 2000 rupees. Then, you are eligible for the EMI process. Therefore, you will have to pay the amount in limited tenure, which is like 3, 6, 9, 12, 24 and 36 months. For the amount more than 30000 you can avail the EMI request for 36 months.

How you can Pay your credit card bills – Without CRED App

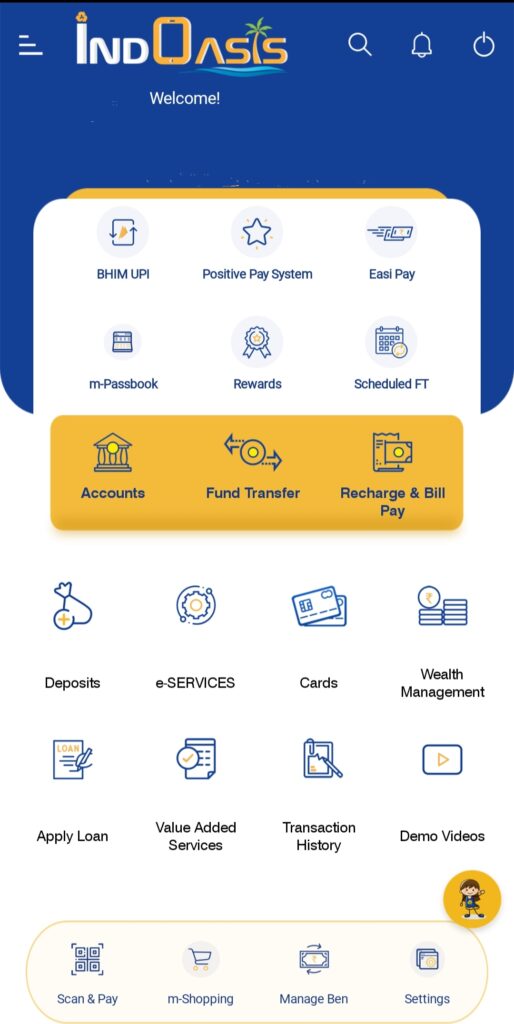

Paying credit card bills can be tricky some time because you have to fill up every shot of things again and again. So, using this method you can pay your bill securely. Means to say, now you can make payment through your INDOASIS Mobile Banking Apps. Here, are the some simple step which you can follow to make payment for your Credit Card bill without using any other apps.

So, if you have Debit Card then it is much easier to start the process. You can log in to your INDOASIS app through your debit card or you can go to your bank branch and start INDOASIS app.

Adding Beneficiary

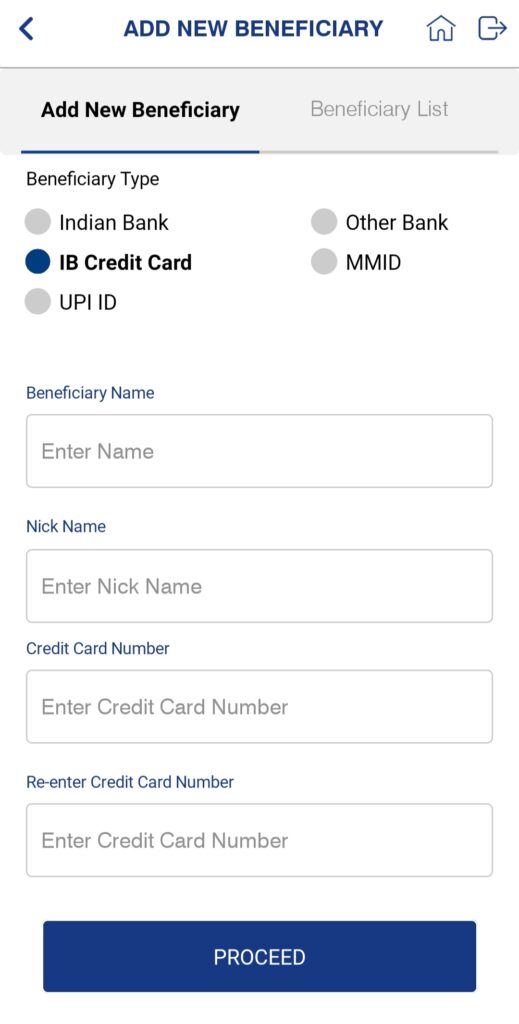

- Now, from Home Screen in the INDOASIS app you can see in the bottom there is an option of Manage Beneficiary click on this option.

- Then, click on the option IB Credit Card

- Fill the Beneficiary Name. In other words, you have to fill the credit card holder name. Note – If the credit card belongs to a Firm or institution then you have to fill the Propritor’s Name. If you will fill up wrong credential. Therefore, your request can be terminated for a while and can ask to try again later.

- You have to fill the Nick Name. Means to say, you have to fill any name which you can remember easily and can remember any time for the transaction.

- Then enter the Credit Card Number and Re-enter the card number.

- Now, click on the Proceed button.

- After this, one window will open to CONFIRM you card details. Then, after confirmation, click on the CONFIRM button.

- Then you have to enter MTPIN which has been provided to you at the time of Login to your INDOASIS app, Fill it here.

- Now you have successfully submitted your beneficiary request for Credit Card and this request takes 4 hours to activate.

Paying for Credit card bills

- After 4 hours, now you can log in to your INDOASIS app. Then, come with the option of Fund Transfer.

- Select the option Bene Pay. To clarify, it means Beneficiary Pay.

- Now select “From” option. From which account you want to send the amount.

- Select “To” option and select the beneficiary which you have added 4 hours ago.

- Then enter the amount which is payable.

- Add remarks. In this option you can fill any option and this is not mandatory to be right.

- Now click on the Proceed Button and confirm the details and then enter the MTPIN to complete the transaction.

Some other Payment Gateway to Pay your Credit Card Bills

- PayTM

- Google Pay

- PhonePe

- Cred Apps

These methods are self proved which is unique. You will not find such content anywhere on the internet. But only here.

To know the procedure for payment from other gateway you can comment below

😊 Thank you 😊